I recently made the mistake of reading the comments on a newspaper story about financial independence. The trolls were wallowing in their self-imposed misery, saying that it's all very well for rich people, blah blah blah. So I thought that I'd take a look at how very ordinary people can make a difference to their retirement.

I recently made the mistake of reading the comments on a newspaper story about financial independence. The trolls were wallowing in their self-imposed misery, saying that it's all very well for rich people, blah blah blah. So I thought that I'd take a look at how very ordinary people can make a difference to their retirement.

I looked at what it would take to boost an ordinary, state pension retirement by 50%.

In case you'd like to play along, this was done using the compound interest calculator here: www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

A full State Pension gives you just about £12k income, and it looks like it'll begin at around age 68 for most of us. Under the current rules, that will basically use up your tax-free Personal Allowance, meaning that any additional income is likely to be taxable. This gave me the target of £6k extra income, after tax, to find.

£12k a year sounds pretty meagre to me, and boosting it to £18k sounds like it would make quite a difference in lifestyle. I think it would make the difference between a couple running a car and going on some holidays, or using the bus and struggling to afford any travel.

We'd need a little more than £6k, to account for income tax. Let's work out roughly how much. Maths isn't my strong point so a bit of trial-and-error is required here for me to estimate that £7k is needed. Here's my reasoning. If this income is coming from a personal pension, 25% of the withdrawal is tax-free and then the rest will be taxed at 20%. £7k - 25% leaves £5,250 to be taxed at 20%, meaning £1050 of tax coming off the £7k to leave about £6k.

If we use a safe withdrawal rate of 4% per year, we'll want a retirement pot saved up of 25 x £7k, or £175,000.

Time to fire up the compound interest calculator to see what it will take to reach that target, using some more trial-and-error.

I'm assuming someone begins earning at age 20, so they have 48 years of saving and compounding, to take them to age 68.

My assumption here is that they'll invest in a global index tracker fund, giving them the market's average return without the risk of investing in individual companies, so that they don't have investing decisions to make.

My assumption here is that they'll invest in a global index tracker fund, giving them the market's average return without the risk of investing in individual companies, so that they don't have investing decisions to make.

Ignoring inflation, so that we can keep everything in today's pounds (to make the spending figures make sense to us in terms of buying power), these index funds have given a long-term average return of 7% per year.

£30 per month invested into a SIPP will give an additional £7.50 from the government - we get our income tax money back on pension contributions.

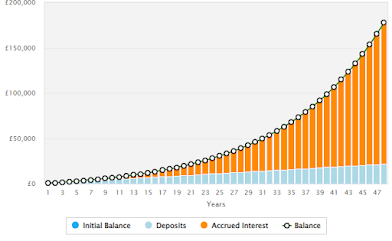

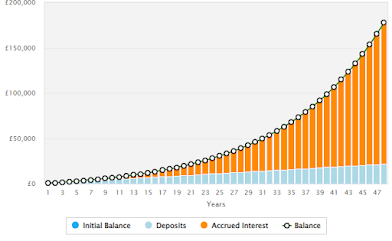

Over our 48 years that monthly contribution builds into a total of £177,878. And just look at the chart to see how much of that total is actual contributions from work, and how much is from compound growth - ie money that we haven't had to go out and earn!

Long time coming

More than 80% of the pot has come from compounding. This just goes to show the power of time with compounding, and the advantages of an early start.

Unfortunately, most of us aren't starting from age 20. We have less time for compounding, so we'd need to throw more money at the problem to reach the same result.

I realise that some people struggle to make ends meet through no fault of their own, but I think most of us would be able to find £30 a month if we set our minds to it. Many of us fritter considerably more money than that on things which we don't particularly value. But this is the cost of a more comfortable future. I think it's a pretty reasonable sacrifice to make.

In fact, these are the sort of numbers which the government have in mind with auto-enrolment into workplace pensions. They want to give us the nudge to save for our own retirements, not at any particularly high level, but just this sort of boost from £12k a year to £18k, where we will be looking after ourselves a bit more.

Unfortunately that has been done poorly, with a lot of our money misdirected so that the typical workplace pension doesn't give anything like as good a return as a simple global tracker, and the people miss out on much of that power of compounding as a result. But that's a soap-box for another day.

I think that most people reading this will be throwing considerably more energy at their retirement than £30 a month, and they'll be seeking an earlier retirement than at state pension age. But the next time someone grumbles "it's all right for the rich", remember what a small step like the one illustrated here would achieve. We can all make use of the power of compounding, in order to secure a better future for ourselves.

Want to read more of my ideas? I have a new book out - Build Your Retirement, 5 ways to improve your wealth in retirement.

I recently made the mistake of reading the comments on a newspaper story about financial independence. The trolls were wallowing in their self-imposed misery, saying that it's all very well for rich people, blah blah blah. So I thought that I'd take a look at how very ordinary people can make a difference to their retirement.

I recently made the mistake of reading the comments on a newspaper story about financial independence. The trolls were wallowing in their self-imposed misery, saying that it's all very well for rich people, blah blah blah. So I thought that I'd take a look at how very ordinary people can make a difference to their retirement. My assumption here is that they'll invest in a global index tracker fund, giving them the market's average return without the risk of investing in individual companies, so that they don't have investing decisions to make.

My assumption here is that they'll invest in a global index tracker fund, giving them the market's average return without the risk of investing in individual companies, so that they don't have investing decisions to make.

No comments:

Post a Comment

Leave a comment